The payback period is a crucial metric for businesses and investors, as it shows how long it takes to recover the initial investment from cash inflows. It helps in evaluating the profitability and risk associated with a project or investment. Calculating the payback period in Excel is relatively straightforward and can save you time in financial analysis. In this guide, we will walk through a step-by-step approach to calculating the payback period in Excel, using simple formulas.

Step-by-Step Guide to Calculating Payback Period in Excel

In this guide, we’ll cover how to set up your investment and cash flow data, apply Excel formulas, and interpret the results. Let’s get started!

Step 1: Set Up Your Data in Excel

Before calculating the payback period, you need to input your data, which typically includes your initial investment and the cash inflows from the investment over time.

a. Input Initial Investment

- In cell A1, label it as “Year” and in cell B1, label it as “Cash Flow”.

- In cell B2, input the initial investment as a negative value (since it’s an outflow of money). For example, if your initial investment is $100,000, input -100,000 in cell B2.

b. Input Cash Inflows for Each Year

- Starting from cell A3, input the years (e.g., 1, 2, 3, 4, etc.).

- In column B, input the expected cash inflows for each year. These are positive values because they represent the money coming in from your investment. For example:

- Year 1: $20,000 (B3)

- Year 2: $30,000 (B4)

- Year 3: $40,000 (B5)

- Year 4: $50,000 (B6)

Step 2: Calculate Cumulative Cash Flows

The cumulative cash flow helps you track how much of your initial investment has been recovered over time.

a. Add a Column for Cumulative Cash Flow

- In cell C1, label it “Cumulative Cash Flow”.

- In cell C2, enter the initial investment amount. This will simply equal the value in B2.

- In cell C3, calculate the cumulative cash flow by adding the previous year’s cumulative cash flow to the current year’s cash inflow. Use this formula in cell C3:

=C2 + B3

For example:

- Year 1 cumulative cash flow:

=-100,000 + 20,000 = -80,000 - Year 2 cumulative cash flow:

=-80,000 + 30,000 = -50,000 - Year 3 cumulative cash flow:

=-50,000 + 40,000 = -10,000 - Year 4 cumulative cash flow:

=-10,000 + 50,000 = 40,000

Step 3: Identify the Payback Period

The payback period is the point when the cumulative cash flow becomes zero or positive, indicating the recovery of the initial investment.

a. Locate the First Positive Cumulative Cash Flow

- Look for the first year in the Cumulative Cash Flow column where the value becomes zero or positive. In this case, it happens in Year 4, where the cumulative cash flow is $40,000.

However, this doesn’t give you the exact point in time when the investment is recovered—it only tells you the year. To get a more precise calculation, you need to determine how much of the cash inflow in the final year was required to reach zero.

Step 4: Calculate the Exact Payback Period

To calculate the exact payback period, you need to account for the portion of the final year’s cash inflow required to fully recover the investment.

a. Formula for Exact Payback Period

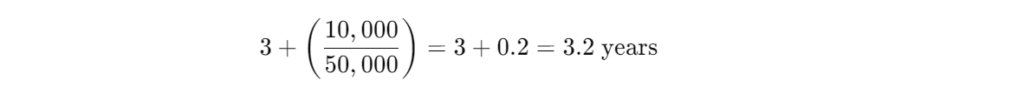

- Find the absolute value of the cumulative cash flow from the year before the payback year. In this example, for Year 3, the cumulative cash flow was -10,000.

- Divide that by the total cash inflow for the following year (Year 4 in this case, which had a cash inflow of $50,000).

- Add this fraction to the number of years up to the payback year.

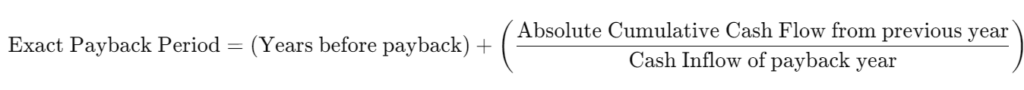

The formula is:

b. Apply the Formula in Excel

This means the payback period is approximately 3.2 years, or 3 years and 2.4 months.

Step 5: Interpret the Results

The payback period of 3.2 years indicates that it will take just over three years to recover the initial investment. A shorter payback period generally suggests a less risky and more attractive investment, while a longer payback period might signal higher risk or lower profitability.

Bonus: Automating the Payback Period Calculation in Excel

If you’re working with multiple projects or investment options, you can automate the payback period calculation by using Excel’s IF function combined with basic arithmetic.

a. Example Formula for Automatic Calculation

- In a new cell (e.g., D1), create a formula that checks when the cumulative cash flow becomes positive. Use a formula like:

=IF(C3>0, A3 - (ABS(C2)/B3), "")

This formula checks whether the cumulative cash flow in Year 3 is positive. If it is, it subtracts the previous cumulative cash flow from the current year’s inflow to find the exact payback period.

Conclusion

The payback period is a simple yet powerful tool for assessing how long it will take to recover an initial investment. Using Excel, you can calculate the payback period quickly by setting up your data, calculating cumulative cash flows, and determining the point at which the investment is fully recovered. With the added benefit of Excel’s automation capabilities, you can streamline this process for multiple investments or projects, making your financial analysis more efficient and accurate.