The Weighted Average Cost of Capital (WACC) is a key financial metric that reflects a company’s average cost of capital from all sources, including equity, debt, and preferred stock. Understanding how to compute WACC is essential for assessing the financial health of a business and making informed investment decisions. This guide will walk you through the process of calculating WACC in Excel, including all necessary formulas and examples.

Step-by-Step Guide to Compute Weighted Average Cost of Capital (WACC) in Excel

This guide will cover the components needed for WACC calculation, how to input them into Excel, and the steps to perform the calculation.

Step 1: Understand the Components of WACC

Before diving into calculations, it’s crucial to understand the components that make up WACC:

- Cost of Equity (Re): The return required by equity investors. It can be estimated using models like the Capital Asset Pricing Model (CAPM). [ R_e = R_f + \beta \times (R_m – R_f) ] Where:

- ( R_f ): Risk-free rate

- ( \beta ): Beta of the stock

- ( R_m ): Expected market return

- Cost of Debt (Rd): The effective rate that a company pays on its borrowed funds. It can be found by looking at the yield on existing debt or bonds.

- Market Value of Equity (E): The total market value of the company’s equity (current stock price multiplied by total shares outstanding).

- Market Value of Debt (D): The total market value of the company’s debt. This can often be calculated as the book value of long-term debt if market values are not available.

- Tax Rate (Tc): The corporate tax rate applicable to the company. This affects the cost of debt because interest expenses are tax-deductible.

Step 2: Gather Your Data

To calculate WACC, you’ll need to collect the following data:

- Risk-free rate ((R_f)): Look up the current yield on 10-year U.S. Treasury bonds.

- Market return ((R_m)): Historical average return of the stock market.

- Company’s beta (( \beta )): Obtain this from financial websites like Yahoo Finance or Bloomberg.

- Market value of equity ((E)): Calculate this as the stock price multiplied by the total number of shares outstanding.

- Market value of debt ((D)): Find the company’s total long-term debt from the balance sheet.

- Corporate tax rate ((T_c)): Check the company’s financial statements or tax filings.

Step 3: Set Up Your Excel Spreadsheet

- Open Excel and create a new worksheet.

- In Column A, list the components of WACC:

- Risk-Free Rate

- Market Return

- Beta

- Cost of Equity

- Market Value of Equity

- Market Value of Debt

- Cost of Debt

- Tax Rate

- WACC

- In Column B, input the values you gathered. It might look like this:

| Component | Value |

|---|---|

| Risk-Free Rate | 3% |

| Market Return | 8% |

| Beta | 1.2 |

| Cost of Equity | |

| Market Value of Equity | $500,000 |

| Market Value of Debt | $200,000 |

| Cost of Debt | 5% |

| Tax Rate | 30% |

| WACC |

Step 4: Calculate Cost of Equity

To calculate the Cost of Equity using CAPM, follow these steps:

- In the cell for Cost of Equity (e.g., B4), input the following formula:

=B2 + B3*(B4-B2)If the risk-free rate is in cell B2, beta is in B3, and the market return is in B4. Adjust the cell references as necessary.

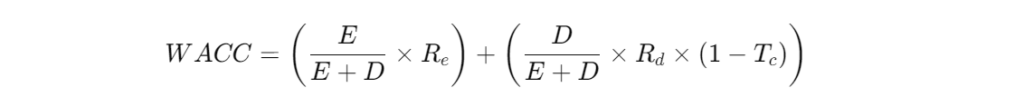

Step 5: Calculate WACC

Now that you have all the necessary components, you can calculate WACC using the following formula:

- In the WACC cell (e.g., B9), input the following formula:

=(B5/(B5+B6)*B4) + (B6/(B5+B6)*B7*(1-B8))Here, adjust the cell references based on where you input the data for Market Value of Equity, Market Value of Debt, Cost of Equity, Cost of Debt, and Tax Rate.

Step 6: Format Your Results

To make your Excel sheet clear and professional:

- Highlight the WACC cell (e.g., B9).

- Right-click and select Format Cells.

- Choose Percentage and set decimal places as needed (usually two).

Conclusion

Calculating WACC in Excel provides valuable insights into the cost of capital for a business. By following the steps outlined in this guide, you can compute WACC accurately, allowing you to make informed financial decisions regarding investments and project evaluations. This calculation is essential for investors, analysts, and corporate finance professionals, enabling them to assess the potential profitability and risk of various investments. Happy analyzing!

FAQs About WACC Calculation

1. What does WACC represent?

WACC represents the average rate of return a company is expected to pay its security holders to finance its assets. It reflects the risk associated with the company’s capital structure and is often used as a discount rate for financial modeling.

2. Why is it important to calculate WACC?

Calculating WACC is crucial for financial decision-making, including investment analysis, corporate finance strategies, and valuing businesses. It helps in assessing whether a company is generating sufficient returns to cover its capital costs.

3. Can WACC be negative?

A negative WACC is uncommon and typically indicates an issue with the data or calculations. If a company has a negative WACC, it might mean the cost of equity is negative, which could occur in unusual market conditions or with extremely high debt levels.

4. How often should WACC be recalculated?

WACC should be recalculated whenever there are significant changes in a company’s capital structure, such as new debt issuance, changes in equity value, or shifts in market conditions that affect interest rates or risk premiums.

5. What is the difference between WACC and the cost of equity?

WACC is the overall required return on the firm’s assets, incorporating the cost of equity, cost of debt, and the proportion of each in the capital structure. The cost of equity specifically refers to the return required by equity investors alone, excluding any debt-related costs.

6. How can I use WACC in financial modeling?

WACC is often used as the discount rate in discounted cash flow (DCF) models to determine the present value of future cash flows. It serves as a benchmark for evaluating investment opportunities and comparing returns across different projects or companies.

With this comprehensive understanding of how to compute WACC in Excel, you can confidently apply this financial metric in your analyses and decision-making processes. If you have further questions or need assistance, feel free to ask!